Probate Lawyer Brandon, FL

Brandon Probate Lawyer

If you’re getting serious about estate planning, it’s important to understand how your passing will affect your family and friends—and our Brandon, FL probate lawyer can help. We’re passionate about helping people build, plan for, and protect their legacies. To get set up with a compassionate attorney with over 25 years of experience, reach out to Morton Law Firm LLC.

What Is Probate?

Probate is the process through which your assets are distributed amongst your beneficiaries. Translated from legalese, it’s how your belongings are split up between your family and friends after your death.

We use the term “asset” to mean everything you own or have built up for yourself. This can range from collectibles to real estate, investments, and even debts. Aside from how your loved ones will remember you, your assets are your legacy, and it’s important to make sure they go to the right people.

What Steps Are Involved In Probate?

Unfortunately, probate is a lengthy and oftentimes frustrating process. Assuming you’ve created a will (which you should have, otherwise you should get in touch with a Brandon probate lawyer as soon as possible), your beneficiaries will have to be notified that you’ve died. Your will also needs to be sent to a probate court for verification.

After everyone is informed of your death, and the court has accepted your will as a legally-binding document, it’s time to get into the weeds. Your assets will need to be gathered and valued, which typically involves a third party. Once everything has been secured and ascribed a monetary value, your final debts, fees, and taxes will have to be paid off.

Once everything has been paid off, it’s finally time to distribute your assets. Seems simple enough on paper, right? There’s one major catch: At every step of probate, there’s an opportunity for debate. This can quickly turn into a grudge-match between your family members who think they’ve been snubbed in the will.

Fortunately, a big part of creating your will is choosing your executor. With the right choice, you can hope for a slightly easier probate process – even though you won’t personally be there to deal with it.

What Is An Executor?

A will is a list of assets and beneficiaries, as well as important instructions for what should be done with your belongings after your death. It’s important to name someone you can trust to handle everything a will entails, and we call that person an executor.

When you name an executor, you’re choosing someone to manage your estate after your death. It’s not a responsibility that should be taken lightly, so it’s important that you name someone you can really trust. If you fail to name an executor, the state will name one for you – and that’s not always the best outcome.

Get In Touch With Morton Law LLC Today

Probate can be a pain, and a will can be difficult to create without the right legal team on your side. At Morton Law LLC, we know how important it can be to plan your future. Get in touch with us today to see how a Brandon probate lawyer from our office can help.

Matthew D. Morton 25+ Years

Assets That Can Avoid Probate

Our Brandon probate lawyer can help you understand what assets must be included in the process of probate and which assets may be able to avoid probate. Our attorney Matthew D. Morton has been helping clients with their estate plans for over two decades. We will use our knowledge and experience to ensure that you are informed throughout the entire probate process.

We understand the importance of preserving your assets and ensuring a smooth transition of wealth to your loved ones. One effective strategy to avoid the probate process is by leveraging various asset planning techniques. To learn more about the probate process and how our probate lawyer can help you, contact the Morton Law Firm today.

Real Estate Trusts

Real estate is often a significant part of an individual’s estate. By transferring ownership of your property to a trust, such as a revocable living trust, you can ensure that it passes directly to your beneficiaries upon your passing without going through probate. Our experienced probate lawyer in Brandon can help you establish and manage a trust that aligns with your specific goals and preferences, providing peace of mind knowing that your real estate assets are protected and efficiently distributed.

Retirement Accounts

Assets held within retirement accounts, such as 401(k)s and IRAs, typically pass directly to the designated beneficiaries outside of probate. However, it’s crucial to ensure that your beneficiary designations are up to date and accurately reflect your wishes. Our experienced probate lawyer can review your retirement account beneficiary designations and recommend any necessary adjustments to ensure a seamless transfer of assets to your loved ones.

Life Insurance Policies

Proceeds from life insurance policies are generally not subject to probate and are paid directly to the named beneficiaries. By designating specific individuals or a trust as beneficiaries of your life insurance policies, you can bypass the probate process and provide financial security for your loved ones in the event of your passing. Our probate lawyer can assist you in reviewing your life insurance policies and beneficiary designations to ensure that they align with your overall estate planning objectives.

Jointly Owned Assets

Assets held jointly with rights of survivorship, such as bank accounts, real estate, and investment accounts, automatically pass to the surviving co-owner without having to pass through probate. This can be a simple and effective way to avoid probate for certain assets. However, it’s essential to understand the implications of joint ownership and ensure that it aligns with your estate planning goals. Our knowledgeable Florida probate lawyer can provide guidance on the advantages and considerations of joint ownership and help you make informed decisions regarding your assets.

Beneficiary Designations

Certain assets, such as bank accounts, brokerage accounts, and vehicles, allow you to designate beneficiaries to receive the assets upon your passing. By specifying beneficiaries on these accounts, you can bypass probate and ensure a direct transfer of assets to your chosen recipients. Understanding the eligibility for certain assets to bypass probate can be complicated, and our probate lawyers can help you make informed decisions regarding your estate plan.

Contact Our Probate Lawyer Today

From establishing trusts and reviewing beneficiary designations to leveraging joint ownership and life insurance policies, our experienced probate lawyers can help you navigate the complexities of estate planning and ensure that your assets are protected and efficiently distributed according to your wishes. Contact the Morton Law Firmtoday to schedule a consultation and take the first step toward securing your legacy for future generations.

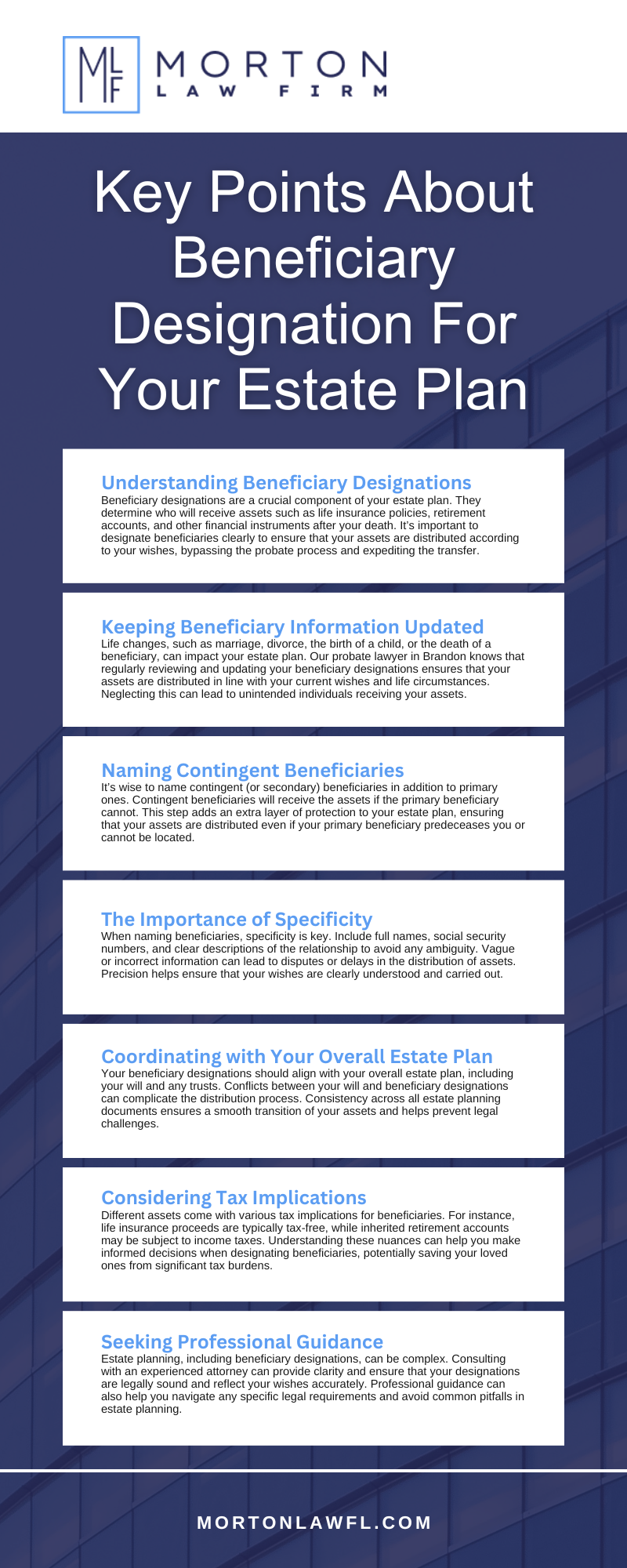

7 Key Points About Beneficiary Designation For Your Estate Plan

When you need help with estate planning and beneficiary designations, don’t hesitate to reach out to our trusted Brandon, FL probate lawyer. Attorney Matthew Morton has helped clients with estate planning needs and can help you when you are ready to go through the estate planning process.

- Understanding Beneficiary Designations. Beneficiary designations are a crucial component of your estate plan. They determine who will receive assets such as life insurance policies, retirement accounts, and other financial instruments after your death. It’s important to designate beneficiaries clearly to ensure that your assets are distributed according to your wishes, bypassing the probate process and expediting the transfer.

- Keeping Beneficiary Information Updated. Life changes, such as marriage, divorce, the birth of a child, or the death of a beneficiary, can impact your estate plan. Our probate lawyer in Brandon knows that regularly reviewing and updating your beneficiary designations ensures that your assets are distributed in line with your current wishes and life circumstances. Neglecting this can lead to unintended individuals receiving your assets.

- Naming Contingent Beneficiaries. It’s wise to name contingent (or secondary) beneficiaries in addition to primary ones. Contingent beneficiaries will receive the assets if the primary beneficiary cannot. This step adds an extra layer of protection to your estate plan, ensuring that your assets are distributed even if your primary beneficiary predeceases you or cannot be located.

- The Importance of Specificity. When naming beneficiaries, specificity is key. Include full names, social security numbers, and clear descriptions of the relationship to avoid any ambiguity. Vague or incorrect information can lead to disputes or delays in the distribution of assets. Precision helps ensure that your wishes are clearly understood and carried out.

- Coordinating with Your Overall Estate Plan. Your beneficiary designations should align with your overall estate plan, including your will and any trusts. Conflicts between your will and beneficiary designations can complicate the distribution process. Consistency across all estate planning documents ensures a smooth transition of your assets and helps prevent legal challenges.

- Considering Tax Implications. Different assets come with various tax implications for beneficiaries. For instance, life insurance proceeds are typically tax-free, while inherited retirement accounts may be subject to income taxes. Understanding these nuances can help you make informed decisions when designating beneficiaries, potentially saving your loved ones from significant tax burdens.

- Seeking Professional Guidance. Estate planning, including beneficiary designations, can be complex. Consulting with an experienced attorney can provide clarity and ensure that your designations are legally sound and reflect your wishes accurately. Professional guidance can also help you navigate any specific legal requirements and avoid common pitfalls in estate planning.

Infographic

Your Probate Questions, Answered

Do I Need A Lawyer To Go Through Probate In Florida?

Our Brandon, FL probate lawyer knows that while it’s possible to handle probate without a lawyer, the process can be complex and time-consuming. Probate involves validating a will, inventorying assets, paying debts, and distributing the remaining assets according to the will or state law. Our lawyer can help ensure everything is done correctly and efficiently. Attorney Matthew Morton has dedicated two decades to helping his clients through difficult situations, such as probate. We can also provide valuable advice and support if disputes arise among beneficiaries or if there are complications with the estate.

How Long Does The Probate Process Take In Florida?

The duration of the probate process in Florida can vary widely depending on the size and complexity of the estate, as well as the efficiency of the probate court. On average, a simple probate case can take about six to nine months from start to finish. However, more complex cases or those with contested wills can take much longer. Working with a knowledgeable probate lawyer from Morton Law Firm can help streamline the process and address any challenges that may arise, potentially shortening the time required to settle the estate.

What Are The Costs Associated With Probate In Florida?

The costs of probate can include court fees, executor fees, attorney fees, and other administrative expenses. Court fees are generally based on the value of the estate, while executor and attorney fees are typically a percentage of the estate’s value. There may also be costs for appraisals, notices to creditors, and other necessary services. By consulting with a probate attorney, you can get a clearer picture of the potential costs involved and find ways to manage and reduce expenses where possible.

What Happens If There Is No Will?

Our probate lawyer in Brandon can tell you that if a person dies without a will, their estate is considered “intestate,” and Florida’s intestacy laws will determine how the assets are distributed. The probate court will appoint a personal representative to handle the estate, and the assets will be distributed according to a predetermined hierarchy of heirs, starting with the spouse and children. This process can become complicated, especially if there are multiple heirs or disputes among family members. An experienced probate attorney can guide you through the intestate probate process, ensuring that the estate is administered fairly and according to Florida law.

Can Probate Be Avoided In Florida?

There are ways to avoid or minimize probate in Florida, such as through the use of living trusts, joint ownership of property, and designated beneficiaries for accounts like life insurance and retirement plans. Proper estate planning with the help of a qualified attorney can help ensure that your assets are distributed according to your wishes without the need for probate. By setting up a comprehensive estate plan, you can provide peace of mind for your loved ones and avoid the time, cost, and potential disputes associated with the probate process.

Probate Glossary

Estate planning involves several legal terms that often come up during the probate process. As your trusted Brandon, FL probate lawyer, we believe it’s important for you to fully understand these concepts before making decisions about your estate. Below are definitions and explanations of key terms and processes you’re likely to encounter when planning your legacy.

Revocable Living Trust

A revocable living trust is a legal arrangement that allows you to transfer ownership of your assets to a trust while you are still alive. You maintain control over the assets and can change or revoke the trust at any time. Upon your death, the assets in the trust pass directly to your named beneficiaries without going through probate.

This tool is often used to manage real estate and high-value personal property. It’s particularly beneficial because it can help avoid delays and court involvement after death. Setting up a revocable living trust may also help preserve privacy, since unlike wills, trusts are not public record.

Beneficiary Designation

A beneficiary designation is a formal statement you make when you open financial accounts or purchase insurance policies, identifying who should receive the proceeds when you pass away. This can include retirement accounts, life insurance policies, and bank accounts.

These designations override instructions in your will, which means if your will says one thing but your retirement account lists a different person, the named beneficiary will receive the account. Keeping these updated is crucial, especially after life changes like divorce, marriage, or the birth of a child.

Joint Ownership With Right Of Survivorship

Joint ownership with right of survivorship refers to a form of property ownership in which two or more individuals own an asset together. When one owner passes away, their share automatically transfers to the surviving owner(s) without probate.

This type of ownership is common with real estate and joint bank accounts. It’s a straightforward way to pass property to a spouse or co-owner, but it’s important to make sure it aligns with your broader estate plan, as it can override other legal documents.

Executor

An executor is the person named in a will who is responsible for managing the estate after someone passes away. This includes filing the will with the probate court, collecting and valuing assets, paying debts and taxes, and distributing what’s left to the beneficiaries.

Choosing the right executor is essential. This person should be trustworthy, organized, and willing to take on the responsibilities involved. If no executor is named, or if the named person cannot serve, the court will appoint someone—often a close relative—to fulfill the role.

Intestate Succession

Intestate succession occurs when someone dies without a valid will. In these cases, state law determines who receives the deceased person’s property. In Florida, this typically starts with the surviving spouse and children, then moves to extended family if necessary.

Because the distribution is dictated by law, it may not reflect your wishes. Creating a clear and legally valid will is the best way to prevent the state from deciding how your property should be divided.

Whether you’re reviewing your existing estate documents or starting from scratch, we’re here to help you take thoughtful steps toward protecting what matters most. At Morton Law Firm, our Brandon probate lawyer can guide you through each decision so your estate plan reflects your true intentions.

Reach out to us today to schedule a consultation and find out how we can help you move forward with confidence.

Get Personalized Estate Planning Help

If you have questions about beneficiary designations or need assistance with your estate plan, our team at Marsh | Rickard | Bryan, LLC is here to help. Attorney Matthew Morton has been a member of the Florida Bar Association since 2000 and is prepared to advocate for you.

Contact us today for a consultation. We’ll work with you to create a comprehensive estate plan that protects your assets and clarifies your wishes